sales tax calculator tulsa ok

This includes the rates on the state county city and special levels. S Oklahoma State Sales Tax Rate 45 c County Sales Tax Rate.

Tax Forms Tax Information Tulsa Library

You can calculate Sales Tax manually using the formula or use the.

. 19 cents per gallon of regular gasoline and. State of Oklahoma 45. If you have a modification that needs to be calculated for another county contact that county directly.

The 8517 sales tax rate in tulsa consists of 45 oklahoma. The oklahoma state sales tax rate is currently. Tulsa has parts of it located within Creek.

Sales tax in Tulsa Oklahoma is currently 852. You can use our Oklahoma Sales Tax Calculator to look up sales tax rates in Oklahoma by address zip code. Use this calculator for Tulsa County properties only.

The current total local sales tax rate in Tulsa OK is 8517. The average cumulative sales tax rate in Tulsa County Oklahoma is 88 with a range that spans from 487 to 1063. Sales tax at 365 effective July 1 2021 General Fund 20.

This is the total of state county and city sales tax rates. Oklahoma State Tax Quick Facts. 70 455 7455.

The Tulsa County Oklahoma Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Tulsa County Oklahoma in the USA using average Sales Tax Rates. The calculator will show you the total sales tax amount as well as the. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365.

Sales tax in tulsa oklahoma is currently 852. 54 rows Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. OK Sales Tax Rate.

Tulsa County 0367. Census Bureau Number of cities that have local income taxes. L Local Sales Tax Rate.

Sr Special Sales Tax Rate. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions.

The oklahoma state sales tax rate is currently. This includes the rates on the state county city and special levels. The average cumulative sales tax rate in Tulsa Oklahoma is 831.

Most transactions of goods or services between businesses are not subject to. The sales tax rate for Tulsa was updated for the 2020 tax year this is the current sales tax rate we are using in the Tulsa Oklahoma Sales Tax. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales.

The December 2020 total local sales tax rate was also 8517. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. S Oklahoma State Sales Tax Rate 45 c County Sales Tax Rate.

Oklahoma Paycheck Quick Facts. L Local Sales Tax Rate. Oklahoma income tax rate.

The Oklahoma sales tax rate is currently. You can calculate Sales Tax manually using the formula or use the. Improve Our Tulsa II 045.

70 455 7455. Sr Special Sales Tax Rate. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does.

Vision Econ Development. Average local state sales tax. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

087 average effective rate. We will not do calculations for other.

Tarrant County Tx Property Tax Calculator Smartasset

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Calculate Car Loan Lease Payments Online Tulsa Ok Broken Arrow

Oklahoma Sales Tax Small Business Guide Truic

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

Tax Forms Tax Information Tulsa Library

Lincoln Vehicle Inventory Tulsa Lincoln Dealer In Tulsa Ok New And Us Ed Lincoln Dealership Jenks Owasso Bixby Ok

Sales Tax Calculator Check Your State Sales Tax Rate

Tax Relief Could Be Coming For Oklahomans Kiowa County Press Eads Colorado Newspaper

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

Historical Oklahoma Tax Policy Information Ballotpedia

Assessor Of Oklahoma County Government

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

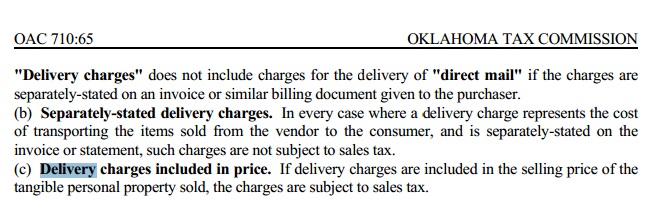

Is Shipping Taxable In Oklahoma Taxjar

/https://s3.amazonaws.com/lmbucket0/media/business/3SJU_Tulsa_OK_20220921212929_Ext_01.8361d0fe01f01c1987e590fbad4e71a232365914.jpg)